VIM, Vendor Invoice Management: what it is and its benefits

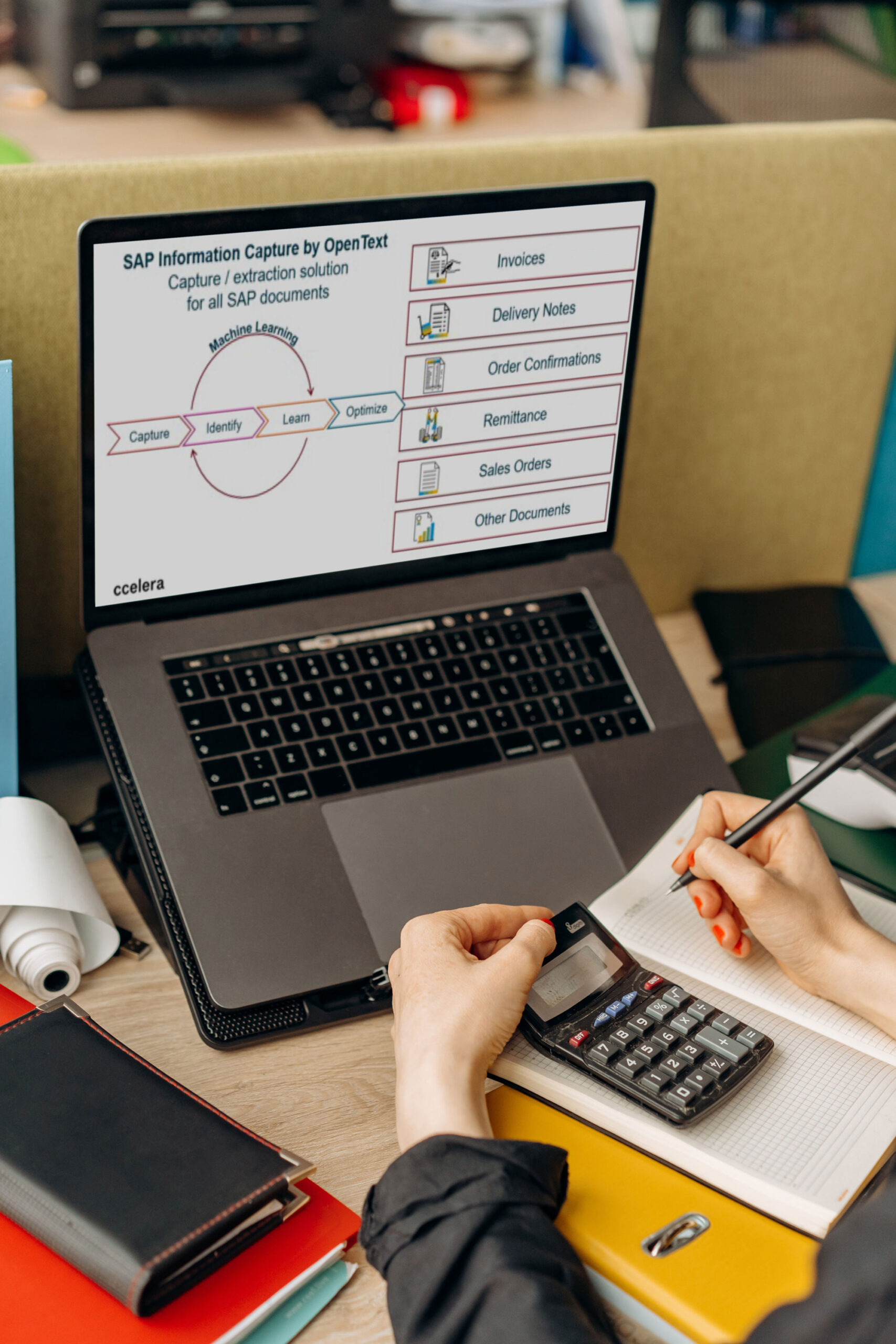

Vendor Invoice Management (VIM) automates the process of managing invoices, delivery notes, sales orders, order confirmations and payment advice, reducing user operations and communication time between supplier and customer.

What is VIM

VIM is a SAP add-on offered by OpenText. It’s installed in SAP and integrates with all modules present.

VIM allows the receipt of payable invoices, enabling a kind of pre-capture of the accounting entry and thus helping the user with the actual entry.

But Vendor Invoice Management by OpenText does much more, and in fact other processes can be activated, including the receipt and management of delivery notes, sales orders, order confirmations, payment advice and more.

What are the benefits of VIM

In this article we’re going to focus on the process of receiving and posting invoices. VIM makes it possible to involve managers from different offices, from accounts payable to warehouse workers, offering them a single dashboard. This speeds up communication times and the resolution of any invoice accounting issues.

VIM enables the automatic entry of accounting data in such a way that human error is reduced as much as possible, resulting in greater peace of mind on the part of suppliers who will thus no longer have problems due to late payments.

This therefore leads to a reduction in accounting times, with the possibility of automating the process by avoiding user intervention entirely with automatic entry by the system.

VIM also allows the activation of an approval flow, both before and after the invoice is posted.

Why choose Vendor Invoice Management

As mentioned, Vendor Invoice Management offers the possibility of reducing accounting times by automating the recording of invoices where possible.

To be able to carry out this process, depending on the customer’s needs, Ccelera is able to propose a customised reading of receipts, especially those in electronic format so that accounting data can be entered automatically, both with orders and without.

Examples of information that we can map from the XML file are stamp duty, CONAI, CIG and CUP. But we can also read information from other files linked to the invoice, such as DURC, SDI ID and SDI receipt date.

We’re able to manage the automatic recording of invoices of different types, such as energy, transport, fuel expenses, utilities.

If automation isn’t possible due to accounting issues, the system is able to detect errors by managing certain controls.

For example, in order to facilitate supplier accounting in cases linked to orders, Ccelera is able to propose a detailed check of any discrepancies in incoming goods with respect to what is stated on the invoice. This way missing entries are noted more quickly, facilitating the involvement of the purchasing department and speeding up the resolution of any issues.

Ccelera is also able to handle country-specific localisations such as the management of PAs in Italy, electronic files (both European and non-EU), Brazil’s nota fiscal and Fapiao with the integration of the Golden Tax System portal.

Finally, Ccelera is able to manage invoices’ pre- and/or post-entry approval flow, adapting the workflow diagram according to the customer’s needs without being locked into a linear configuration.

Features and how it works

VIM’s process is based on macro-flows:

- Creation of the VIM document

- Assignment of the document to a given flow

- Completion of the data

- Invoice entry

The creation of the VIM document includes the initial phase of receiving and reading the invoice, filling in the minimum data necessary for the invoice to be recorded.

The flow determination phase indicates which type of entry is to be made.

The basic VIM solution has three main flows:

- Invoices with orders. Thus set up for posting invoices against purchase orders.

- Invoices without orders. So without the need to link invoices to POs.

- Advance invoices.

The third phase, that of data completion, involves user involvement as the system will highlight any “issues” that can only be resolved by the user.

These issues are called “Exceptions”. For each exception, a specific office will be involved according to the type of error.

For example, if there are inconsistencies on the PO, the purchasing department can be directly involved.

In VIM these offices are represented by VIM Roles.

The system handles up to 110 pre-configured exceptions, which can be activated and modified according to the company’s needs.

There are 52 roles, which again can be activated and modified as desired.

Once all issues have been resolved, it’s possible to move on to the fourth and final step: the recording of the invoice.

Integration with other systems

In order to enable the receipt of payable invoices, the standard VIM allows integration via:

- The full version of SAP eDocument

- The use of IDOCs received in SAP from ARIBA

In order to be able to read payable invoices in PDF format, it is possible to use the OCR offered by OpenText, Business Centre Capture.

Furthermore, it’s possible to adapt VIM to solutions that are not totally standard.

Conclusion

SAP Invoice Management by Opentext is a useful tool that facilitates the user in invoice verification thanks to its versatility. The more the system is helped to read the data available, the more this will allow for automatic invoice entry.

Finally, note that VIM not only handles Italian electronic invoicing, but also reads the standard configurations of many electronic formats for a variety of use cases and countries. For example: Germany, Serbia, Croatia, India and others. If the standard is not sufficient, Ccelera is able to modify the system to handle other formats.

See also: SAP Emarsys, the customer engagement platform designed to accelerate business results.

Leave us your email and we’ll get back to you shortly.